Esther Bond, Research Analyst at Slator. published the following article in which she shares how the European Union’s Translation Centre is reducing the share of translation services outsourced to external language service providers. Excel Translations does not endorse, recommend, or make representations with respect to the following content.

From large multi-annual government contracts to public institution spend, the public sector is a big driver of demand for translation globally. In Europe, one major public sector buyer of translation is the European Union, whose Translation Centre (CdT) racks up over USD 50m in annual revenues from translation services. The CdT is the EU’s internal provider of linguistic shared services, which processes translation requests from all EU agencies.

The CdT provides forecasts for its annual revenues, and released its predictions for 2019 in October 2018. The 2019 budget forecasts total revenues of EUR 46.7m (USD 53.9m) in 2019, down from EUR 47.1m in 2018, but up from EUR 46.0m in 2017.

Price per page for the purpose of calculating the budget remains unchanged from 2018 at EUR 82 per page. Prices are higher for urgent and classified translation services, as well as for complex formatting, PDF and translation into a non-EU language. Discounts are offered for longer turnaround times.

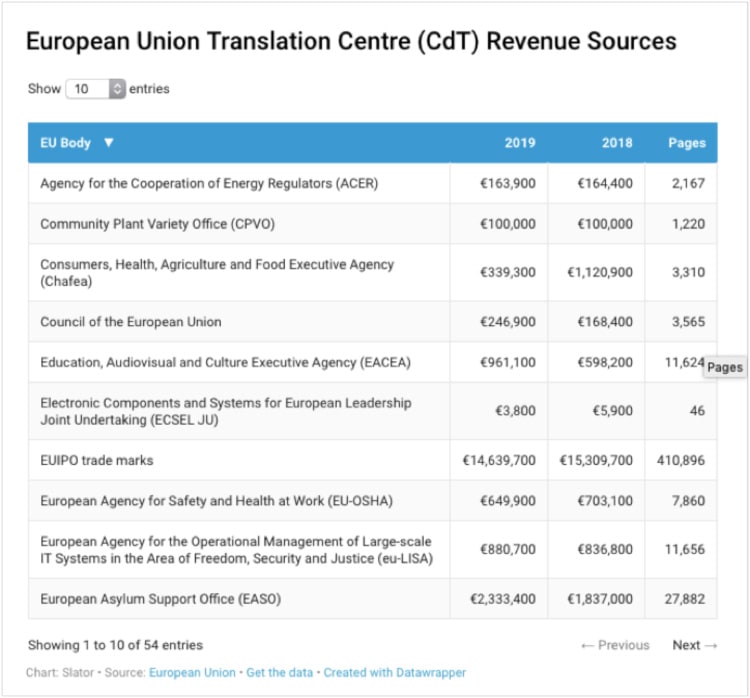

Agency Spend and Page Counts

The CdT generates revenues from across its internal customers, the EU agencies, who have differing levels of translation demand, hence differing spend. The revenue from each agency is displayed in the table for 2018 and 2019, alongside number of pages. In addition to agency billing, the CdT brings in revenues from a number of other areas, such as the IATE database, which is forecast to generate EUR 707,400 in 2019.

Although the 2019 forecast is calculated using the pricing applicable in 2018 (EUR 82 per page), the budget in fact reveals that the CdT is seeking approval from its management board to hike up prices from the start of 2019 “to enable to Centre to continue to balance its budget.” If the pricing increase is approved, the 2019 budget will be revised upwards and presented in March 2019.

The 2019 budget also explains that the forecast is mainly based on numbers given by the individual agencies and therefore may be somewhat unreliable since “clients may not have taken into consideration the impact of potential savings arising from the pricing structure.” According to the budget, “15.9% average savings were obtained by clients in 2017 compared with the 9.5% originally envisaged.”

“This increase […] is partly compensated by the significant decrease of […] as a result of reducing the volume of outsourcing to external language service providers”

Among the CdT’s biggest spenders in 2019, the EUIPO is forecasting a decrease in spend of 4.4% from 2018 and EU trade marks is forecasting a drop of 6.2% from 2017, as highlighted in the budget. The budget also points to the decrease in forecast spend from the EMA (-14.8%), Chafea (-69.7%) and ESMA (-62.7%) as notable. Frontex, EACEA, ECHA and EASO have increased their forecast spend compared with 2018.

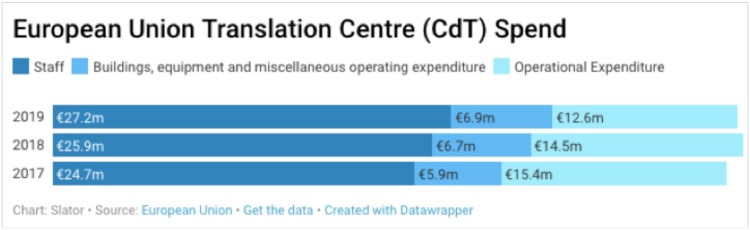

More on Staff, Less on LSPs

With its 2019 forecast revenues, the CdT will cover its own annual spend, which largely comprises staffing (EUR 27.2m), buildings, equipment and miscellaneous operating expenditure (EUR 6.9m) and operational expenditure (EUR 12.6m). The chart below displays the CdT spend from 2017, 2018 and 2019 across these three categories.

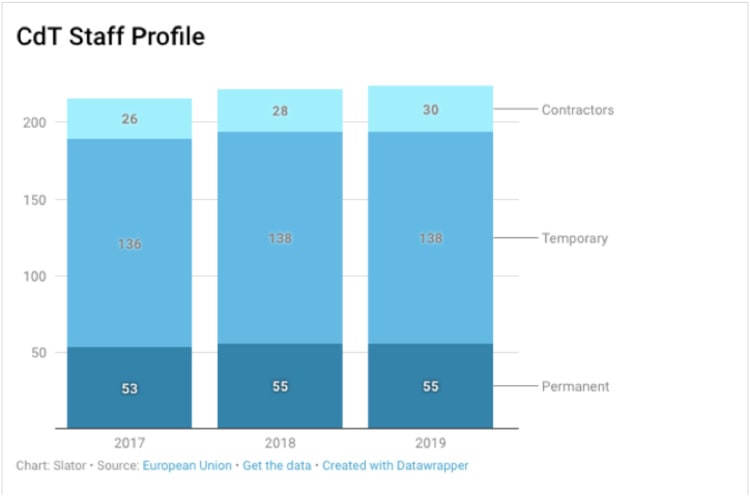

Staff costs are forecast to increase in 2019 vs 2018 and 2017 as is the amount that the CdT expects to spend on buildings, equipment and misc operating expenditure. The budget forecasts a headcount of 55 permanent staff, 138 temporary staff and 30 contractors in 2019, and says that staff costs have increased by 1.4% between 2017 and 2019.

The increase in these two categories is mainly offset by the lower forecast spend on operational expenditure, which the budget says is “as a result of reducing the volume of outsourcing to external language service providers.” Spend in this category is forecast at 13.4% less than 2018.

According to the budget, “the Centre has taken several measures to reduce its budget expenditure in order to respond to the decrease in forecast revenue” and the budget will be used to “cover only what is expected to be needed. This means that the Centre has reduced its margin to a minimum across key budget lines and its flexibility is therefore severely reduced.” Moreover, “higher salary indexations, price increases for the Commission’s services, or higher costs than forecast for the outsourcing of translation services could therefore necessitate reprioritisations in the Centre’s budget,” the document warns.

Leave a Reply